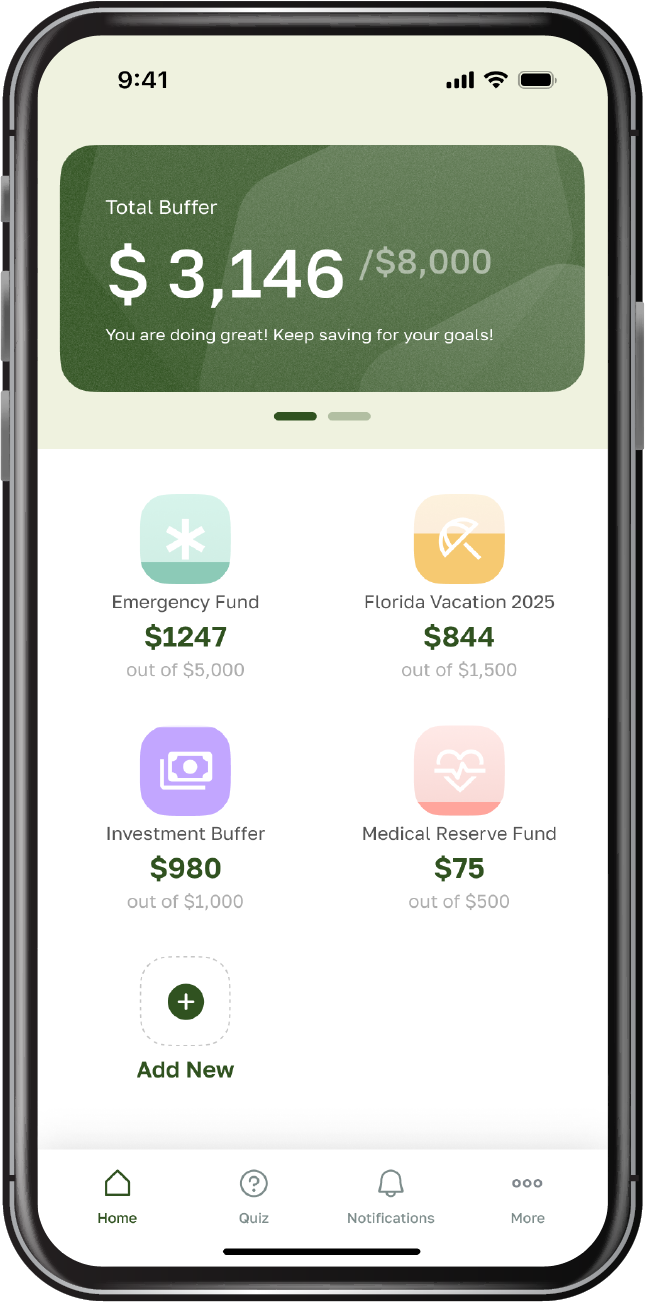

Track Multiple Savings Goals

Organize funds for emergencies, vacations, investments, and more.

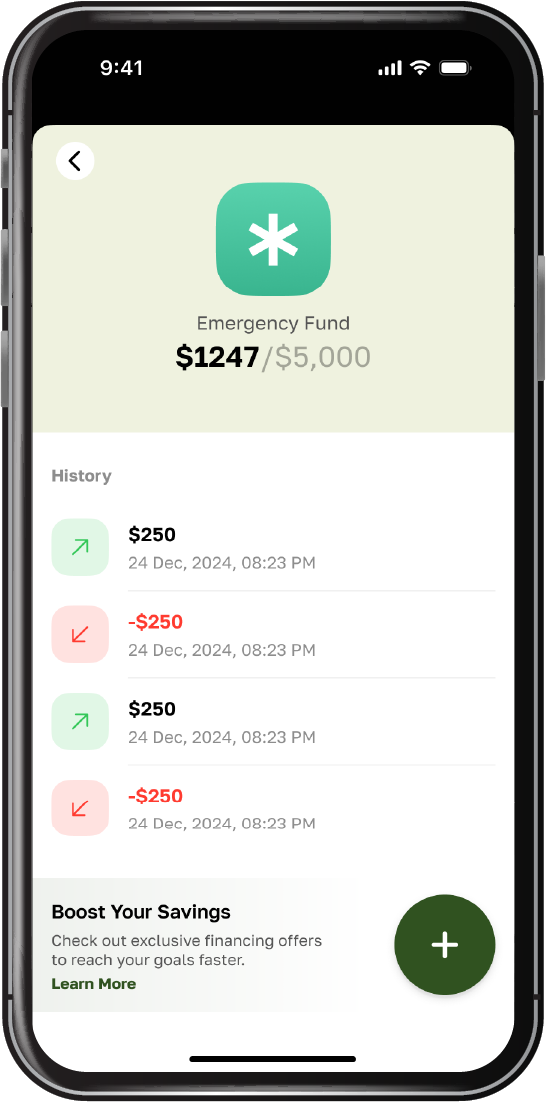

Build your emergency fund effortlessly and stay prepared for life’s surprises. Track, manage, and grow your savings with ease.

Get Started for Free

Organize funds for emergencies, vacations, investments, and more.

Find out how much you should save based on your income and expenses.

Easily deposit and withdraw money from your savings accounts.

Get notifications to stay motivated and on track.

Your financial information is safely stored and protected.

Whether you’re looking to start a new project or simply want to chat, feel free to reach out to us!